How Do You Apply For An Fha Loan

How Do You Apply For An Fha Loan - A Federal Housing Administration (FHA) loan is a home mortgage that is insured by the government and issued by a bank or other lender approved by the agency. FHA loans require a lower down payment than most conventional loans, and applicants may have lower credit scores than typically required.

FHA loans are designed to help low- and moderate-income families own a home. They are especially popular with first-time home buyers.

How Do You Apply For An Fha Loan

If you have a credit score of at least 580, you can borrow up to 96.5% of your home's value with an FHA loan by 2022. This required down payment is only 3.5%.

Fha Loan Requirements, Benefits, And How To Qualify

If your credit score is between 500 and 579, you can get an FHA loan if you can make a 10% down payment.

With FHA loans, the down payment can come from savings, a financial gift from a family member, or a down payment assistance grant.

The FHA does not give anyone money for a mortgage. The loan is issued by a bank or other financial institution approved by the FHA.

FHA guarantees the loan. This makes it easier to get bank approval because the bank does not bear the risk of default. Some people call it an FHA-insured loan.

Home Purchase Loans

Borrowers who qualify for an FHA loan must purchase mortgage insurance, with premium payments going to FHA.

Congress created the FHA in 1934 during the Great Depression. At the time, the housing industry was in trouble: default and foreclosure rates were skyrocketing, typically 50% down payments were required, and mortgages were unaffordable for modest wage earners. As a result, the US has become primarily a nation of renters, with only one in 10 households owning their home.

The government created the FHA to reduce risk for lenders and make it easier for borrowers to get home loans.

According to research by the Federal Reserve Bank of St. Louis, the home ownership rate in the US has been steadily rising, reaching 69.2% in 2004. In the first quarter of 2022, the indicator was 65.4%.

Understanding Fha Loans And Application Requirements

Although primarily intended for low-income borrowers, FHA loans are available to everyone, including those who can afford a conventional mortgage. Generally, borrowers with good credit and strong finances are better off with a conventional mortgage, while those with bad credit and a lot of debt can use an FHA loan.

This is a reverse mortgage program that helps seniors 62 and older cash out the equity in their home while retaining their home title. A homeowner can borrow funds in a fixed monthly amount, on a line of credit, or a combination of the two.

This loan adds the cost of certain repairs and upgrades to the loan amount. It's perfect for those willing to buy a fixer-upper and put some sweat into their home.

This program is similar to the FHA 203(k) home improvement loan program, but it focuses on upgrades that lower utility bills, such as new insulation or solar or wind energy systems.

Fha Loans: Rates And How To Apply

This program works for borrowers who expect their income to grow. A Graduated Payment Mortgage (GPM) starts with lower monthly payments that gradually increase over time. Growing Equity Mortgage (GEM) has scheduled monthly principal payments. Both shorten the term of the loan.

A graduated payment mortgage (GPM) has a low initial monthly payment that increases over time. Growing Equity Mortgages (GEM) have scheduled monthly principal payments to shorten the loan term.

Your lender will evaluate your eligibility for an FHA loan just like any mortgage applicant, starting by verifying that you have a valid Social Security number, are a legal resident of the US, and are of legal age (according to your state's laws). .

FHA loan criteria are somewhat stricter than bank loan criteria. However, there are some strict requirements.

Instamortgage|fha Loans Requirements, Loan Limits And Applying

Whether it's an FHA-guaranteed loan or not, your financial history will be examined when you apply for a mortgage.

FHA loans are available to individuals with credit scores below 500. This is in the "very poor" range for a FICO score.

If your credit score is between 500 and 579, you can secure an FHA loan as long as you can afford a 10% down payment. Additionally, if you have a credit score of 580 or higher, you can get an FHA loan with a 3.5% down payment.

In comparison, applicants typically need a credit score of at least 620 to qualify for a conventional mortgage. The down payment required by banks varies from 3% to 20%, depending on how willing they are to lend when you apply.

Homebuyer's Guide To Applying For An Fha Loan In Nc

As a general rule, the lower your credit score and down payment, the higher the interest rate you will pay on your mortgage.

The lender will look at your work history for the past two years, as well as your payment history for bills such as utilities and rent.

Individuals who are behind on their federal student loan payments or income tax payments are not eligible unless they agree to a satisfactory repayment plan. A history of bankruptcy or foreclosure can also be problematic.

Generally, to qualify for an FHA loan or any type of mortgage, a borrower must have experienced a bankruptcy or foreclosure for at least two or three years. However, exceptions may be made if the borrower can demonstrate that he has worked to restore good credit and get his finances in order.

Kentucky Fha Loan Requirements For 2023

The mortgage must be paid off, and an FHA-approved lender wants assurance that the applicant can achieve this. The key to determining whether a borrower can meet their obligations is proof of recent and steady employment.

If you have been self-employed for less than two years but more than one year, you may still qualify if you have had reliable employment and a history of earnings in the same or related occupation for the two years prior to self-employment.

Your mortgage payment, HOA fees, property taxes, mortgage insurance, and homeowners insurance must be less than 31% of your gross income. Banks call this a front-end relationship.

Additionally, your savings ratio, which consists of your mortgage payment and all other monthly consumer debt, must be less than 43% of your gross income.

Different Types Of Fha Loans

Upfront MIP + 11 year annual MIP or LTV and loan life depending on loan length

None with at least 20% down payment or after the loan is paid up to 78% LTV

An FHA loan requires the payment of two types of mortgage insurance premiums (MIPs) - the upfront MIP and the annual MIP, which is paid monthly. In 2022, the preliminary MIP is 1.75% of the principal loan amount.

![]()

You can pay the MIP upfront at closing or convert it into a loan. For example, if you get a home loan for $350,000, you'll pay an upfront MIP of 1.75% x $350,000 = $6,125.

Common Questions About Fha Loans In Washington State

These payments are deposited into an escrow account managed by the US Department of the Treasury. If you default on your loan, the funds go toward paying off your mortgage.

Despite its name, borrowers make monthly annual MIP payments, with payments ranging from 0.45% to 1.05% of the base loan amount. Payment amounts vary depending on the loan amount, loan term, and initial loan-to-value (LTV) ratio.

Let's say you have an annual MIP of 0.85%. In this case, a $350,000 loan would result in MIP payments of 0.85% x $350,000 = $2,975 (or $247.92 monthly). These monthly premiums are paid in addition to the one-time MIP payment. You will make annual MIP payments for 11 years or the life of the loan, depending on the length of the loan and LTV.

You can get a tax deduction for the premium paid. To do this, you must itemize deductions instead of taking the standard deduction.

Should You Refinance Your Fha Loan?

Generally, the property being financed must be your primary residence and must be owner-occupied. In other words, the FHA loan program is not intended for investment or rental properties.

Detached and semi-detached homes, townhouses, townhouses and condominiums in FHA-approved condominium projects are eligible for FHA financing.

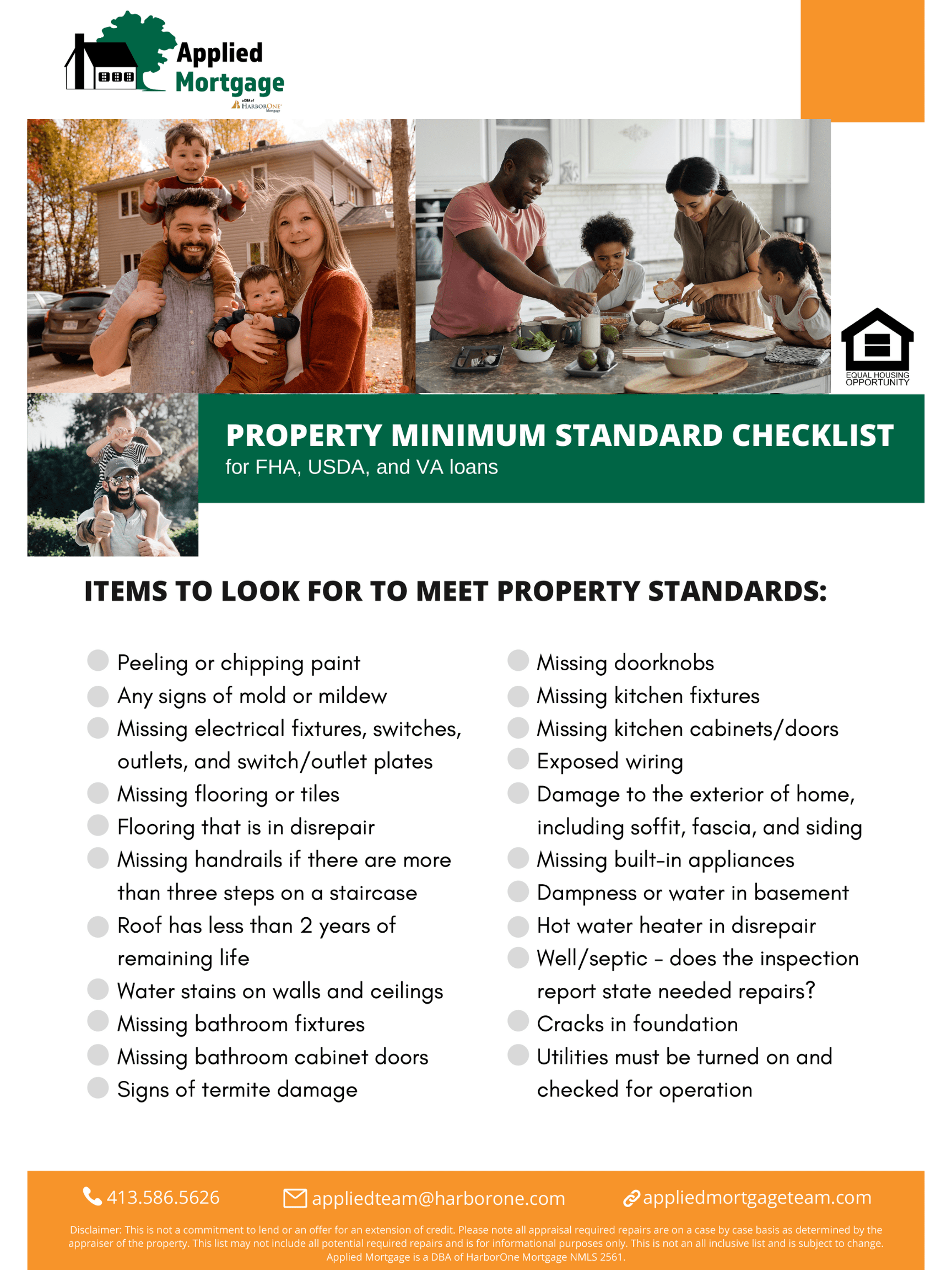

You also need to have the property appraised by an FHA-approved appraiser, and the home must meet certain minimum standards. If the home does not meet these standards and the seller does not agree to the necessary repairs, the repairs must be paid for at closing. (In this case, funds are held in escrow until repairs are made.)

FHA loans have limits on how much you can borrow. These are zoned, with a lower limit than a typical FHA loan (called a "floor") and high-cost areas with a higher rate (called a "ceiling").

What Is A Fha (federal Housing Administration) Loan?

There are "special" areas where extremely high construction costs make the restrictions even higher, including Alaska, Hawaii, Guam and the US Virgin Islands.

Elsewhere, the cap is set at 115% of the county's median home price,

Post a Comment for "How Do You Apply For An Fha Loan"